Bitcoin: What is it?

It is very difficult today to find someone who hasn’t heard of Bitcoin, or cryptocurrency in general, but it is just about impossible to find a consensus on the future of these digital coins. You will often hear that they are a scam, people are going to lose all the money they have invested, and often that this digital money is only used by criminals and drug dealers as main payment system …

You will also hear about people who became millionaires in a few years starting with a low investment in Bitcoin. Let’s take a step back and look at a more comprehensive picture, and understand what is good about cryptocurrency, what is possibly bad, and what could be the ugly side of it.

How money came about

First, let’s have a look at how money was invented and has since evolved into the system we have today.

Gold coins

Money has existed for a long time, and originated from bartering with livestock and food to using rare metal coins. The first traceable coin originates in what in now Turkey, around 600BC and was an alloy of gold and silver, representing a roaring lion.

The coin, valued as a rare metal, was more transportable, and was somehow divisible as you could scrape the metal of the coins and pay small amount in gold dust and more practical to deal with than camel or goats.

Paper money

The first paper money was invented by the Chinese, around 400AD and Marco Polo who travelled to China, found it so practical that he brought the concept back to Europe. Paper money was harder to accept but seems to have been in use around 1640AD in Europe. Until about 50 years ago, paper money was a representation of its real value in gold, gold which was kept in a government bank. Today, there is no link between the gold reserve of a country and the value they can print on paper, hence a constant loss of value every time the government prints another batch of money.

Plastic Money

After the second world war, the concept of plastic money was invented, which in fact is more of a payment system that does not require having the paper money available in hand, but a guarantee from the bank that your transaction will be honoured. It is a representation of the paper money, designed to make it safer, easier to transport and convenient for commercial transactions.

Cryptocurrency

Cryptocurrency originated in 2009 with the invention of Bitcoin by an unknown person or group who published it under the name Satoshi Nakamoto. Bitcoin is a cryptocurrency and can be used as a payment system. It is the first digital currency, which works without a central bank or single administrator and operates on the internet. Transactions take place between users directly, without an intermediary, and are verified by network nodes through the use of cryptography and recorded in a public distributed ledger called a blockchain.

A mathematical formula requires a calculation to establish each coin through a process called mining, people mining or managing the network are rewarded when they identify new coins or when they validate the transactions on the network.

How does it work – simply explained:

A cryptocurrency is entirely virtual, you never have anything in hand but a link to a repository where the currency is held.

To make it easier to understand, we should understand the concept of a pair of keys, one public key and one private key. Let’s assume you have a key (your private key) attached to a piggy bank and that piggy bank is in a public area, visible by everyone.

When people look at all the piggy banks, they cannot see their content, nor who owns them nor any private key, but each piggy bank is identified by a its public key, which is secretly linked to its private key. So, if you have the private key of your piggy bank, you can see the content, and you can move currency from that piggy bank to another one, you just need to know the public key of a piggy bank to send currency to it. Crypto currencies can only live in a piggy bank, they have no existence outside of it.

You can also give the public key of your piggy bank to anyone who you would like to receive a payment from, and using this public key, anyone can transfer cryptocurrency to your piggy bank. You could anonymously make your public key available as a QR code, and people could transfer payment to your piggy bank without knowing who you are.Each coin is original, it cannot be faked nor copied, and each transaction is final, once your currency has been transferred, it is gone, you have no way to access it ever, which makes the transaction very safe as the recipient knows he is getting a real coin that nobody can take back.

The good …

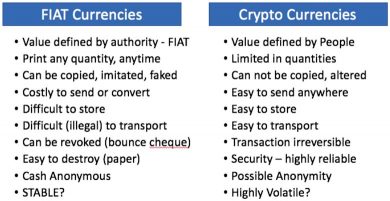

How can we compare the traditional money, called FIAT* currency versus cryptocurrency?*Fiat is a latin words that means “so be this” to expresses the value set arbitrarily by a government You can easily see the advantage of the cryptocurrency,

where the number of Bitcoins is limited to 21 million coins, and no additional coin can be issued, which automatically leads to its increase in value with time.

How can you join the number of people who have invested and be part of this amazing transformation? It is not extremely complicated but it can be painstaking because of the regulations that banks must comply with, and you need to start from a bank account with local currency to be used to purchase your first coins. Your exchange will need to make sure you respect the “AML” anti money laundering regulation and the “KYC” know your customer rule, meaning you must be clearly identified to open your account at the exchange to trade in cryptocurrency. Passed this, everything is a lot easier.

The bad …

You can purchase coins on the exchange, keep them there if the amount is low but if your investment is significant, it is better to transfer your currency to a wallet. The main difference is that when your money is on an exchange, you do not own the private key, they do and you access an account with a user name and password where they give you the value of your currency, if the exchange goes bust or get hacked, you have lost your coins.

Your wallet is in fact the repository of your private key, with a piece of software that will access your public piggy bank through the private key and give you an overview of the amount of cryptocurrency held in your piggy bank. The exchange (example here is a Thai exchange) you might have selected to start with your currency will depend where your FIAT currency is, because exchanges are not always accepting currencies from unknown new customers, as a result, if you start in Thailand, your exchange will have a limited number of coins, and you might want to purchase currencies of different nature which your exchange does not hold. Once you have coins in an exchange, you can move them to your wallet or to another exchange where you have been accepted and you can trade coins.

The ugly

The risks with cryptocurrency are quite high, and there are many ways you can be left with less money than you started with. What are some of the big risks? The first one is volatility, Bitcoin started a few cents, and reached in December an all-time high of 20,000USD per Bitcoin. For those who purchased them for a few dollars, this is a massive gain! But for those who joined at 20,000USD in December, today (Jan 2nd) the value dropped back at 13,000USD, so an extremely sharp loss. It is impossible today to predict which way the Bitcoin will go, however there are many signs that indicate that it will climb back to 20,000USD and continue to climb.The second one is simply the loss of your currency, and this can happen in many ways.

- Your exchange can be hacked, this has happened in the past, or the owner can pretend to have been hacked but have in fact pocketed your coins.

- You could simply also lose your private key, many early investors who bought their coins at a very cheap value did not really pay attention to their key and lost it, which means that there are several piggy banks around with lots of coins in and nobody can claim ownership.

- You might also make a false manipulation, handling coins requires extreme attention and some basic knowledge, if for instance you transfer one currency from an exchange to another currency but select a public key in a different currency (ie: you transfer Bitcoin to an Ethereum (ETH) address) your coins would simply be lost. If the value is high, the exchange might offer to help recover them but at a significant cost.

- Your wallet has many protection mechanism to avoid losing it, for instance, if your telephone (or computer) is where your wallet is, you would have a backup mechanism through which if you were to lose your phone or crash, you could restore your wallet on another phone or computer without any loss, but it also means that if your phone (or computer) is compromised with a Trojan, the person who compromised you can access your wallet and steal your coins.

- The scams, due to the nature of the system, it is very easy to entice someone to transfer coins to a wallet thinking they are doing a transaction with a person but in fact they have been directed to a fake public address and are sending their coins to a thief. This is extremely common in the world of ICO (initial coin offering) where you are interested in an investment in a new crypto venture and you are purchasing coins or token from that company. Hacked website or phishing sites will trick investors to send their coins to their address and the transaction is irrecoverable.

Security today is however very high if you apply basic knowledge and common sense to your coins and the structure where they are held.

First, you need to use a 2-factor authentication mechanism to access your exchange or account, meaning a password must be complemented by a code from your phone, then you need to make sure you do not use your phone or computer on sites where there is a risk of virus or Trojan (always use legal software and up to date antivirus) and have a backup of your data and a copy of your private key on a paper wallet in your safe, and a copy in another safe.

If you want to know more about Bitcoin investment, security of your wallet and portfolio, or legal aspects of the cryptocurrency applicable to your country for tax purpose, SafeComs and DHDL hold regular seminars on cryptocurrency where you will get all information to start safely and protect your investment. Write to the author ([email protected]) to get more information and a timetable for the seminars.

You can also read more about crypto in our Crypto Trading 101 guide.