Finding the right coverage for COVID-19 insurance

by Ms. Suvimol Sathanart

Healthcare is an essential part of financial planning especially if you are working and living overseas as an expat. With the current pandemic situation and rapid developments happening around us it’s important to know what insurance products are available.

Here are some of the factors you should consider when purchasing insurance policies that will give you the adequate coverage you need? Here are some points to consider before you decide to buy COVID-19 insurance policies.

Understanding the insurance policy, what is covered and what is excluded.

1. Stand alone COVID-19 insurance policies will protect the insured against medical expenses and death benefit as a result of the insured being diagnosed with COVID-19 virus.

2. There will be an age range from which one can buy the coverage. It can range from 1 years old up to 99 years old depending on which insurance plan you choose.

3. Waiting period: some insurers will have a waiting period for example 14 days from the time that the coverage begins, and claims can only be payable after the duration of the waiting period.

4. Certain professions may be excluded from buying the insurance for example, pilot and flight attendants, those who work at the airport and medical professionals.

5. Lump sum payments: look out for the benefits covered under the policy as some policies will provide a lump sum payment upon diagnosis of COVID-19 whilst others may not provide this benefit.

6. Death benefit: some insurers will provide coverage for death benefit but again this is up to each individual policy terms and conditions

7. Look out for terms and conditions of the plan as some insurers do not cover foreign nationals. Certain companies such as Dhipaya Insurance can cover foreign nationals who hold work permits and proof of residence in Thailand for more than 6 months. So, it’s important to check with each insurance plan before you make the purchase.

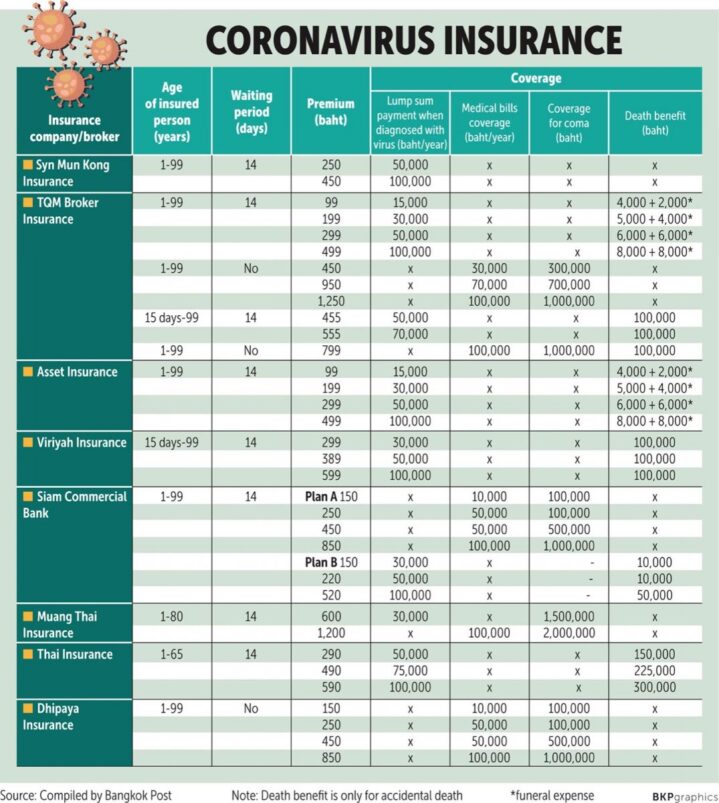

Attached is a table of comparison which was prepared by Bangkok Post on the various policies that are available in the market by insurance company/broker. Please note that this is just a sample of what’s currently available and the list is not exhaustive. There continues to be a host of new products launched by insurers so it’s best to check with each insurer on the most up to date product offering.

Apart from COVID-19 insurance policies it’s essential to understand that your health insurance policies can also cover you for medical expenses incurred from COVID-19 unless there are specific exclusions about infectious diseases under your health insurance policy. If you have life insurance policies death benefits will be payable in the event of mortality from COVID-19.

My recommendation is for you to do a financial health check and review whether you have adequate protection for health, life, personal accident insurance coverage. Having adequate coverage will give you a peace of mind and protect you financially in the event that you need medical care. You can either seek professional advice from insurance brokers/agents or you can purchase these policies yourselves – some insurers offer online purchase so you can buy it on the website with electronic payment.